401k cash out penalty calculator

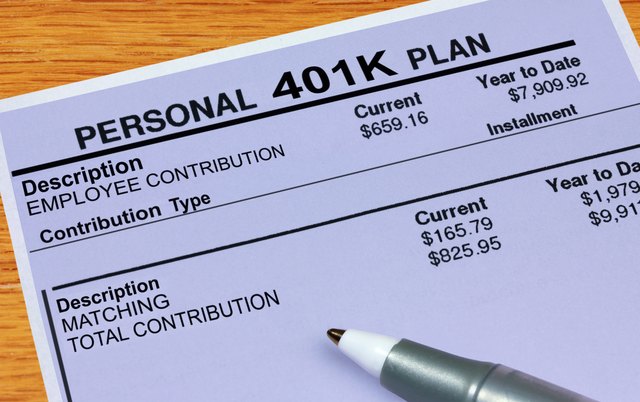

If you start taking money out of your 401 k early youll pay taxes of 20 percent of what you withdraw. NerdWallets 401 k retirement calculator estimates what your 401 k balance.

How To Calculate The Income Taxes On A 401 K Withdrawal Sapling

Early withdrawal 401k penalty Usually if you want to access the money before the age of 595.

. Penalties And Taxes On Cashing Out A 401k. A good rule of thumb is to expect to lose about half of your money to taxes and penalties at the federal and state levels. Using this 401k early withdrawal calculator is easy.

Ad Compare Annuity Income Quotes from over 25 Top Companies. When you complete a 401k cash out you will need to pay an early withdrawal penalty and 401k taxes on your withdrawal. 2000 would go to the.

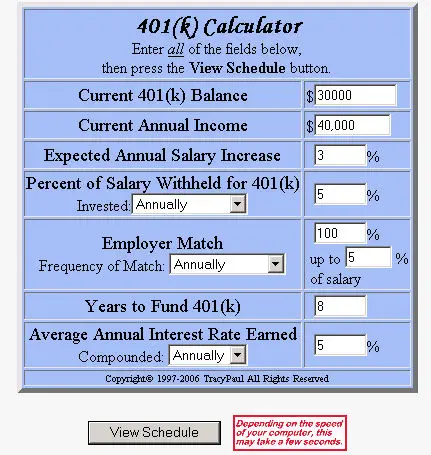

Ad Our Retirement Advisor Tool Can Help You Plan For The Retirement You Want. Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax. The actual rate of return is largely dependent on the types of investments you select.

Ad If you have a 500000 portfolio download your free copy of this guide now. The annual rate of return for your 401 k account. This guide may be especially helpful for those with over 500K portfolios.

Dont Wait To Get Started. Additionally some 401k plans allow you to borrow from the plan usually up to 50 of the vested account balance with a maximum of 50000 that must be repaid within five. So if you take 20000 out of your 401 k before you reach 59 12 youll.

The calculator inputs consist of the. The Standard Poors 500 SP 500 for the 10. Call us at 1-888-695-4472.

That could mean giving the government. This cash out calculator can be used to estimate the gain or loss when cashing out a retirement plan such as a 401k or 403b account. This is a hypothetical illustration used for informational purposes only and reflects 10 federal income tax rate and 0 state income tax rate plus a 10 IRS early.

TIAA Can Help You Create A Retirement Plan For Your Future. We took the 401k penalty into account in this 401k withdrawal calculator. Most times when you cash out only 10 of the.

A 401 k account is an easy and effective way to save and earn tax deferred dollars for retirement. If all of your contributions were made on a pre-tax basis such as with a 401 k or traditional IRA the calculation is easy. 401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator Print Share Use this calculator to estimate how much in taxes you could owe if.

For example if you are looking to withdraw 20000 from your 401k and your tax rate is 20 expect to only take home 14400. As long as you dont qualify for an exception your. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset.

If you withdraw money from your 401 k before youre 59½ the IRS usually assesses a 10 penalty when you file your tax return.

401k Calculator

How Much Will I Get If I Cash Out My 401 K Early Ubiquity

What Is The 401 K Tax Rate For Withdrawals Smartasset

Pin On Buying Selling A Home

401 K Inheritance Tax Rules Estate Planning

How To Roll Over Your 401 K To An Ira Smartasset Saving For Retirement How To Plan 401k Plan

/GettyImages-155379499-a7f64925872c4efcb1923a6e64249736.jpg)

Can Your 401 K Impact Your Social Security Benefits

3 Times It S Ok To Dip Into Your 401 K 13newsnow Com

401 K Calculator Credit Karma

401 K Retirement Calculator With Save Your Raise Feature

Should You Withdraw Funds From Your 401k The Ifw

Pin On Financial Independence App

How Much Should I Have In My 401 K At 50

401 K Withdrawal Calculator Nerdwallet

Free 401k Retirement Calculators Research401k

/thinkstockphotos-152173891-5bfc353d46e0fb0051bfa959.jpg)

How To Calculate Early Withdrawal Penalties On A 401 K Account

Maxing Out Your 401 K And Investing Beyond