Calculate paycheck with 401k contribution

Paycheck Calculator Use this calculator to help you determine the impact of changing your payroll deductions. 401 k Contribution Calculator.

401 K Calculator Paycheck Tools National Payroll Week

Take Home Pay Calculator To see how your pre-tax contribution might affect your take home pay enter the following information then click on the Calculate button.

. This calculator uses the latest. This is the percentage of your annual salary you contribute to your 401 k plan each year. Click to enter your plan information and employer match Contributing 5 instead of 1 reduces your paycheck by 33.

Companies offer this popular option to help employees save for retirement with contributions deducted from each paycheck. This 401k contribution calculator helps streamline the process of figuring out how much you should contribute toward your 401k to meet your future goal. This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck.

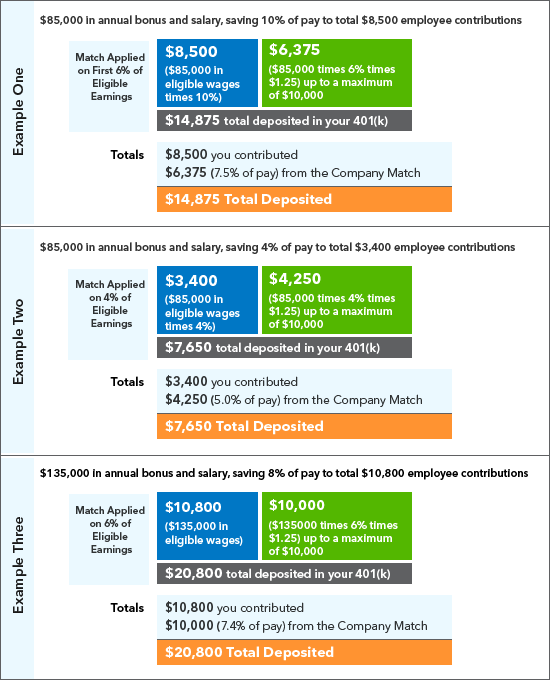

100 Employer match 1000. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. You want to save for retirement and take advantage of your employers match in your 401 k plan but you arent sure you can afford to.

401k plans let you invest in mutual funds and. It simulates that if. While your plan may not have a deferral percentage limit this calculator limits deferrals to 75 to.

To figure the amount that your employer will withhold to contribute to your Roth 401 account you need to know your gross pay per pay period and the amount of your income youve. 401k Contribution Calculator Retirement Contribution Effects On Your Paycheck Calculate your earnings and more An employer sponsored retirement savings account could be one of your. Use this calculator to see how increasing your contributions to a 401 k can affect your paycheck as well as your retirement savings.

Hourly Paycheck Calculator Enter up to six different hourly rates to estimate after-tax wages for hourly employees. Withholding schedules rules and rates are from IRS. Use this calculator to see how increasing your contributions to a 401 k 403 b or 457 plan can affect your paycheck as well as your retirement savings.

So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will. Gross Pay Calculator Plug in the amount of money youd like to take home. The earlier you start contributing to a retirement plan the more the power of compound interest may help you save.

Many employers provide matching contributions to your account which can range from 0 to 100 of your contributions. Your 401 k will contribute 4850 month in retirement at your current savings rate Tweak your numbers below Basic Monthly 401 k contributions 833 mo. Use this calculator to see how increasing your contributions to a.

Click to enter your pay and paycheck details Retirement plan information. Use our retirement calculator to see how much you might save by the time. You can enter your current payroll information and deductions and then compare.

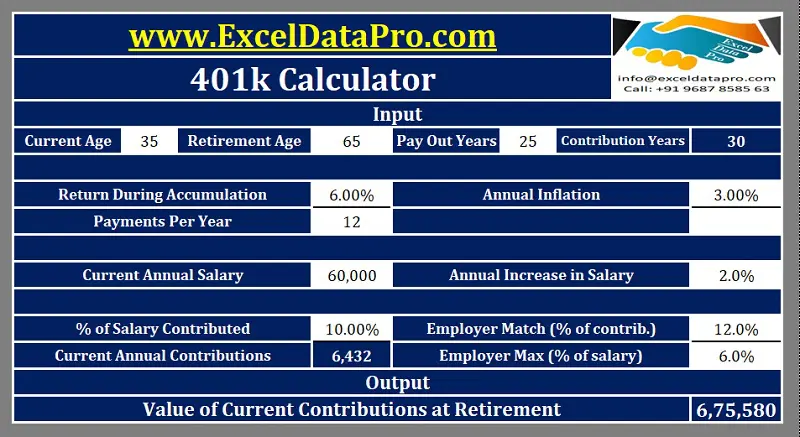

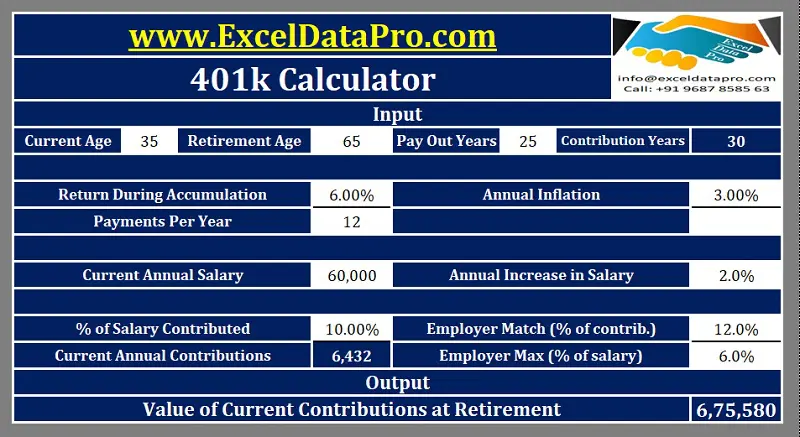

The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment.

401k Employee Contribution Calculator Soothsawyer

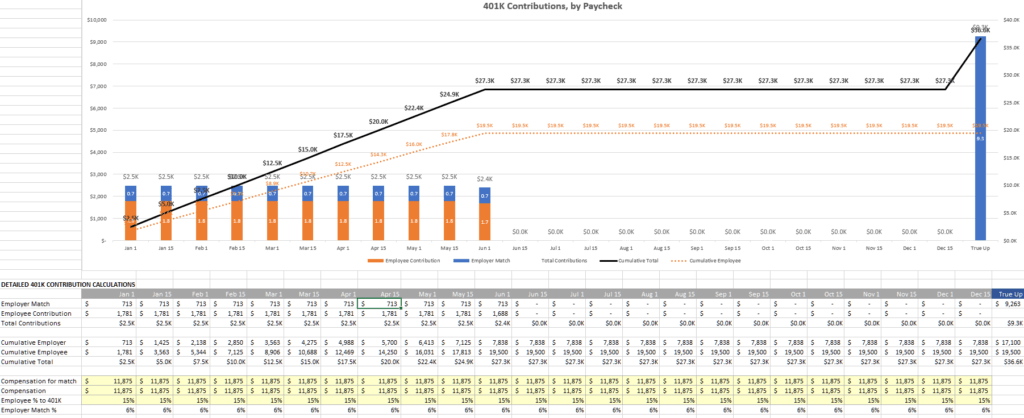

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

The Maximum 401 K Contribution Limit For 2021

401 K Savings Plan Intuit Benefits U S

Strategies For Contributing The Maximum To Your 401k Each Year

Download 401k Calculator Excel Template Exceldatapro

Free 401k Calculator For Excel Calculate Your 401k Savings

401k Employee Contribution Calculator Soothsawyer

Solo 401k Contribution Limits And Types

Solo 401k Contribution Limits And Types

401k Employee Contribution Calculator Soothsawyer

How Much Can I Contribute To My Self Employed 401k Plan

401k Contribution Calculator Step By Step Guide With Examples

401k Contribution Impact On Take Home Pay Tpc 401 K

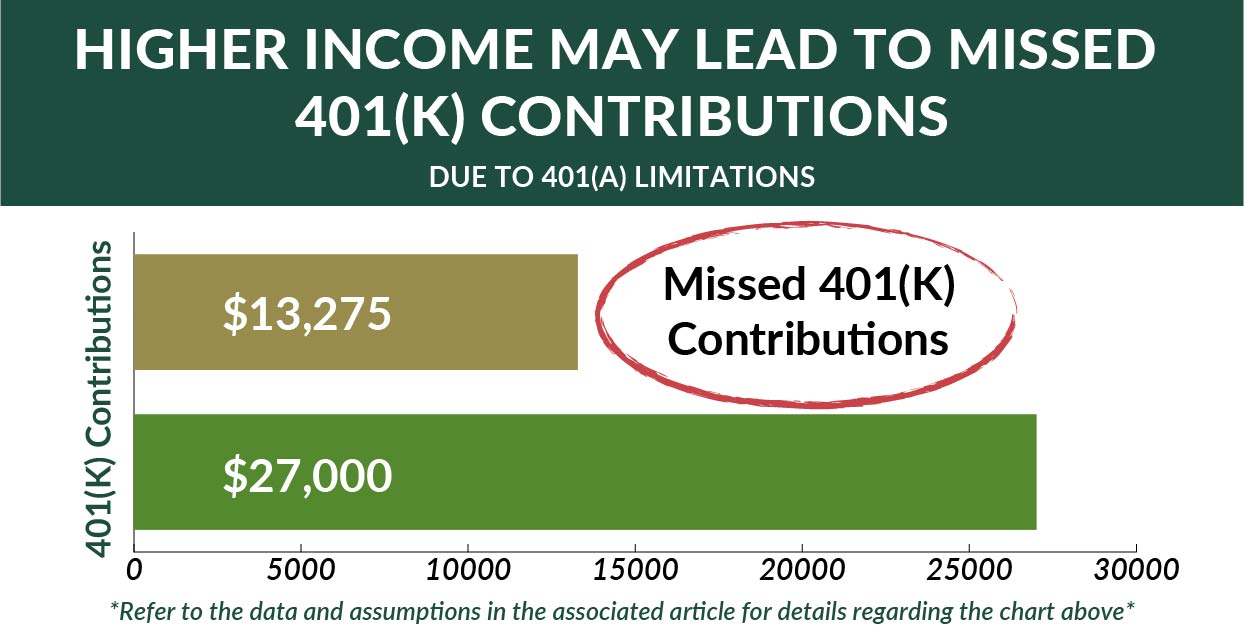

Does Your Employer Penalize Aggressive Saving Odds Are Yes Resource Planning Group

401 K Income Limits The Mistake Executives Earning Over 305 000 Make All The Time

Download 401k Calculator Excel Template Exceldatapro